Investing in the stock market offers multiple opportunities to grow wealth, but understanding the different types of stocks is crucial to making the right choices for your portfolio. One common way to categorize stocks is based on market capitalization, separating them into small-cap, mid-cap, and large-cap stocks. While each category offers unique advantages and risks, this blog will focus on comparing small-cap and large-cap stocks, helping you determine which one is best suited for your investment portfolio. Read Basics of Stock Market

In this detailed guide, we’ll cover the characteristics, advantages, and drawbacks of both small-cap and large-cap stocks to help you make informed investment decisions. By the end, you’ll be equipped with the knowledge to tailor your portfolio to your financial goals.

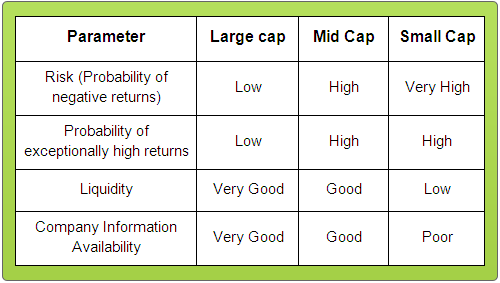

The below table shows the analysis of different parameters on Large Cap, Mid Cap and Small Cap Funds.

What is Market Capitalization?

Before diving into the differences between small-cap and large-cap stocks, it’s essential to understand the concept of market capitalization. Market capitalization, often referred to as “market cap,” is the total market value of a company’s outstanding shares. It is calculated by multiplying the current share price by the total number of shares outstanding. Read More

What is Outstanding shares?

Outstanding shares refer to the total number of shares of a company’s stock that are currently owned by all its shareholders, including institutional investors and company insiders. These shares represent the equity ownership in a company and are a key part of calculating a company’s market capitalization.

Outstanding shares include:

- Shares held by the public: This includes individual and institutional investors.

- Restricted shares: These are shares owned by insiders, such as executives and employees, which may have restrictions on when they can be sold.

Outstanding shares do not include treasury shares, which are shares the company has repurchased and holds in its own treasury.

For example, if a company has issued 100 million shares and bought back 10 million, the outstanding shares would be 90 million.

- Small-Cap Stocks typically have a market capitalization between $300 million and $2 billion.

- Large-Cap Stocks have a market capitalization of $10 billion or more.

Market capitalization serves as a useful metric to gauge the size of a company, with larger market cap companies generally being more established and smaller ones potentially offering higher growth opportunities.

Small-Cap Stocks: What You Need to Know ?

Small-cap stocks refer to the shares of smaller companies, usually newer or in the early stages of growth. These companies often operate in niche markets or emerging industries and may not yet have the brand recognition or financial backing that large-cap companies enjoy.

Characteristics of Small-Cap Stocks:

- Higher Growth Potential: Small-cap companies are often in the growth phase, meaning they have significant room for expansion and innovation. Investors who buy into small-cap stocks early may see large returns if the company grows successfully.

- Higher Volatility: Due to their smaller size and lower market presence, small-cap stocks are typically more volatile. Prices can fluctuate more dramatically, both upward and downward, making them riskier investments.

- Less Analyst Coverage: Small-cap stocks are often overlooked by analysts, meaning there may be fewer resources to guide investors in their decision-making. This can make research and due diligence more difficult but also offers the potential to discover undervalued opportunities.

Examples of Small-Cap Stocks:

Some well-known companies that started as small-caps include Monster Beverage and Netflix. Many investors who identified their potential early were rewarded as these companies grew into giants.

Large-Cap Stocks: What You Need to Know

Large-cap stocks belong to established companies with significant market share, stable earnings, and strong reputations. These stocks are considered safer investments because large-cap companies usually have more predictable earnings, making them less risky during economic downturns.

Characteristics of Large-Cap Stocks:

- Stability and Security: Large-cap companies often dominate their respective industries, offering stability. They have extensive resources, diversified product lines, and large customer bases, making them more resilient to market fluctuations.

- Lower Growth but Steady Returns: While large-cap stocks typically don’t offer the same rapid growth potential as small-caps, they do provide consistent returns. Many large-cap companies also pay dividends, which can be attractive for income-focused investors.

- Widespread Analyst Coverage: Large-cap stocks are widely covered by financial analysts, making it easier for investors to find research reports, earnings projections, and expert opinions. This can simplify the investment process for individuals looking for dependable choices.

Examples of Large-Cap Stocks:

Some household names that fall under the large-cap category include Apple, Microsoft, Amazon, and Johnson & Johnson. These companies are leaders in their industries, offering relatively lower risk and stable returns.

Key Differences Between Small-Cap and Large-Cap Stocks

| Factor | Small-Cap Stocks | Large-Cap Stocks |

|---|---|---|

| Market Cap | $300 million to $2 billion | $10 billion and above |

| Growth Potential | Higher | Moderate |

| Volatility | High | Low |

| Risk | Higher | Lower |

| Liquidity | Lower | Higher |

| Dividends | Rare | Common |

| Analyst Coverage | Limited | Extensive |

| Company Size | Smaller, growing firms | Established industry leaders |

Advantages and Risks of Small-Cap Stocks

Advantages:

- High Growth Potential: Investors can benefit from rapid growth if the company succeeds, offering the possibility of large returns.

- Undervalued Opportunities: Since small-caps are less scrutinized, savvy investors might find undervalued stocks with great potential.

- Diversification: Adding small-cap stocks to your portfolio can help diversify risk across industries and company sizes.

Risks:

- High Volatility: Prices of small-cap stocks tend to swing dramatically, exposing investors to greater short-term risks.

- Less Liquidity: Smaller companies may have fewer shares traded, leading to difficulties in buying or selling shares quickly.

- Limited Resources: Small-cap companies often lack the financial strength and flexibility of large-caps, making them more vulnerable to economic downturns.

Advantages and Risks of Large-Cap Stocks

Advantages:

- Stability: Large-cap stocks tend to be less volatile than small-caps, offering a more stable investment option, especially during market downturns.

- Dividends: Many large-cap companies pay regular dividends, providing investors with a steady income stream.

- Lower Risk: With established market positions and steady earnings, large-cap stocks are generally considered safer investments.

- Liquidity: Large-cap stocks are highly liquid, making it easier to buy and sell shares as needed.

Risks:

- Lower Growth Potential: Large-cap companies are often already leaders in their industries, limiting their potential for rapid growth compared to small-caps.

- Market Sensitivity: While large-cap stocks are generally stable, they can still be affected by broader economic changes or market downturns.

Which is Best for Your Investment Portfolio?

The choice between small-cap and large-cap stocks largely depends on your financial goals, risk tolerance, and investment timeline. Here’s a breakdown to help you decide:

Choose Small-Cap Stocks If:

- You are an aggressive investor seeking higher returns and willing to tolerate higher risk.

- You have a long investment horizon and can afford to wait out short-term volatility.

- You are comfortable conducting research to identify undervalued opportunities in the market.

- You are looking to diversify your portfolio with growth-focused assets.

Investment Portfolio : When to choose Large-Cap Stocks ?

- When you prefer stability and consistent returns with lower risk.

- When you are nearing retirement or seeking income through dividends.

- When you have a conservative investment approach and prefer well-established companies.

- When you are seeking to preserve capital while growing your wealth over time.

Investment Portfolio :Combining Small-Cap and Large-Cap Stocks:

For many investors, the best approach is a balanced portfolio that includes both small-cap and large-cap stocks. This provides exposure to the high-growth potential of small-caps while maintaining the stability and steady returns of large-caps. This diversification reduces the overall risk of your portfolio while offering opportunities for both growth and income.

Conclusion

Deciding between small-cap and large-cap stocks is not a one-size-fits-all process. Each type of stock has its own set of advantages and risks, and the best choice for your portfolio will depend on your individual financial goals, risk appetite, and investment strategy.

Small-cap stocks offer high growth potential but come with greater volatility and risk. They may be ideal for younger investors with a long-term outlook and the ability to weather short-term market fluctuations. On the other hand, large-cap stocks provide more stability, lower risk, and steady returns, making them better suited for conservative investors or those seeking dividend income.

Ultimately, creating a diversified portfolio with a mix of small-cap and large-cap stocks can provide the best of both worlds, offering growth potential while minimizing overall risk. Whichever route you choose, understanding the characteristics of these stocks and aligning them with your investment goals will help ensure long-term success.

For more insights on building your portfolio, check out our resources on stock diversification and long-term investing strategies.